Employment and taxes everfi answers are a vital component of financial literacy. This comprehensive guide delves into the intricacies of income and employment taxes, providing clear explanations and practical insights to help individuals navigate the complexities of tax obligations.

This guide covers a wide range of topics, including the different types of income taxes, employment taxes, and tax forms. It also discusses tax credits, deductions, and strategies for tax planning and preparation.

Income Taxes

Individuals pay various income taxes, including federal, state, and local taxes. These taxes are calculated based on their taxable income, which is the amount of income subject to taxation after subtracting deductions and exemptions.

Taxable Income

Taxable income includes wages, salaries, tips, bonuses, self-employment income, investment income, and other forms of compensation. Certain deductions can be subtracted from taxable income, such as standard deductions, itemized deductions (e.g., mortgage interest, charitable contributions), and certain business expenses for self-employed individuals.

Tax Brackets

Tax brackets are ranges of taxable income that determine the tax rate applied to that income. Higher income levels typically fall into higher tax brackets, resulting in a higher proportion of income being taxed. The impact of tax brackets on income tax liability is that individuals with higher taxable incomes pay a higher percentage of their income in taxes compared to those in lower tax brackets.

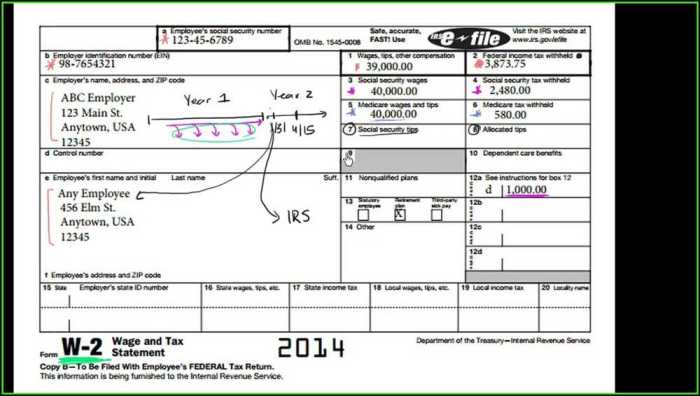

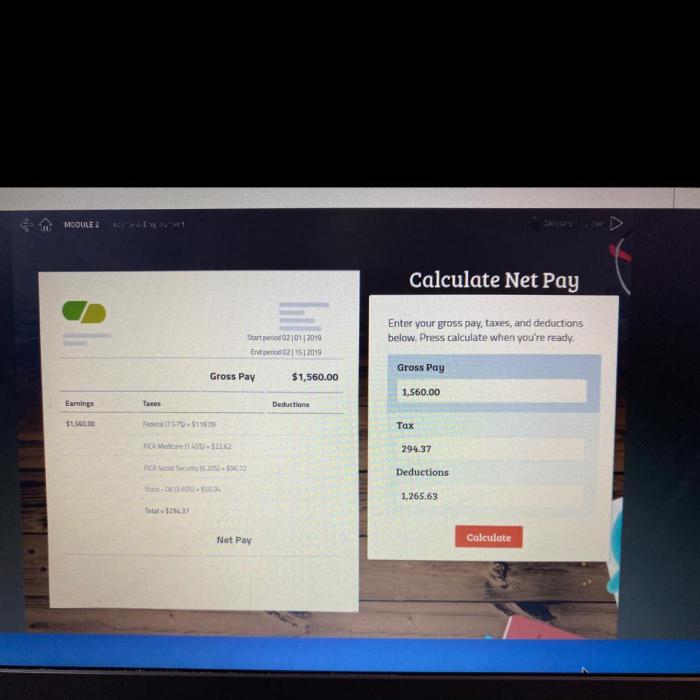

Employment Taxes

Employment taxes are mandatory contributions withheld from an employee’s wages to fund various government programs, including Social Security, Medicare, and unemployment insurance. These taxes are crucial for ensuring the financial security of both employees and the nation as a whole.

There are several types of employment taxes, each with its own specific purpose and calculation method:

- Social Security tax: This tax funds the Social Security program, which provides retirement, disability, and survivor benefits to eligible individuals.

- Medicare tax: This tax funds the Medicare program, which provides health insurance to individuals over the age of 65, as well as those with certain disabilities.

- Federal income tax: This tax is withheld from wages to prepay the employee’s annual income tax liability.

- State and local income taxes: These taxes are withheld from wages to prepay the employee’s state and local income tax liability, if applicable.

Employment taxes are calculated as a percentage of the employee’s gross wages. The specific percentage for each tax varies depending on the type of tax and the employee’s income level.

Employers are responsible for withholding employment taxes from their employees’ wages and submitting the collected taxes to the government. Employees are responsible for ensuring that their employers are withholding the correct amount of taxes and for paying any additional taxes owed when they file their annual tax return.

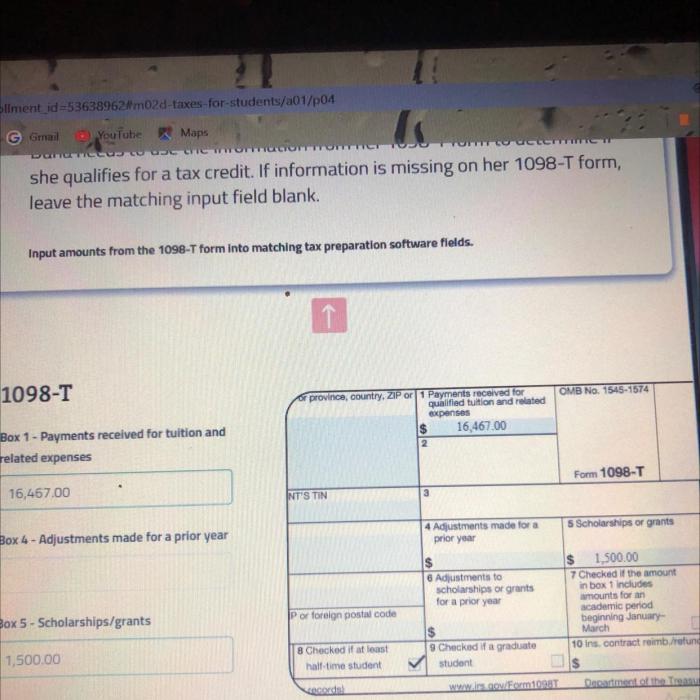

Tax Forms and Filing

Individuals are required to file tax returns annually to report their income and calculate their tax liability. The specific forms required vary depending on the individual’s circumstances, but the most common forms include the Form 1040, Form 1040-EZ, and Form 1040-A.

The Form 1040 is the most comprehensive tax form and is used by most taxpayers. It includes schedules for reporting various types of income, deductions, and credits. The Form 1040-EZ is a simplified version of the Form 1040 and can be used by taxpayers with simple tax situations.

The Form 1040-A is used by taxpayers who are not required to file a return but who want to claim a refund of taxes withheld from their paychecks.

Filing Tax Returns, Employment and taxes everfi answers

Tax returns can be filed electronically or by mail. Electronic filing is the faster and more accurate method, and it is also the preferred method of the IRS. Taxpayers can file their returns electronically using tax preparation software or through the IRS website.

When filing a tax return, it is important to be accurate and complete. Taxpayers should make sure to include all of their income and deductions, and they should sign and date the return before mailing it to the IRS.

Timely Filing

Tax returns are due on April 15th of each year. Taxpayers who file late may be subject to penalties and interest charges. The IRS offers extensions for filing, but taxpayers should only request an extension if they have a valid reason for not being able to file on time.

Tax Credits and Deductions

Tax credits and deductions are two common ways to reduce your tax liability. While both credits and deductions lower your tax bill, they do so in different ways. Understanding the difference between the two can help you maximize your tax savings.

Tax Credits

A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe. For example, if you qualify for a $1,000 tax credit, you will owe $1,000 less in taxes. Tax credits are typically refundable, which means that if the amount of the credit exceeds your tax liability, you will receive a refund from the government.

Some common tax credits include:

- Child tax credit

- Earned income tax credit

- American opportunity tax credit

- Lifetime learning credit

Tax Deductions

A tax deduction reduces your taxable income, which in turn reduces the amount of taxes you owe. For example, if you have a $1,000 deduction, your taxable income will be reduced by $1,000. This will result in a lower tax bill.

Some common tax deductions include:

- Standard deduction

- Itemized deductions

- Business expenses

- Charitable contributions

Strategies for Maximizing Tax Savings

There are a number of strategies you can use to maximize your tax savings through credits and deductions. Some of these strategies include:

- Claiming all eligible tax credits

- Itemizing your deductions

- Taking advantage of tax-advantaged accounts

- Making estimated tax payments

Tax Planning and Preparation

Tax planning is a crucial year-round endeavor that helps individuals and businesses optimize their financial positions and minimize their tax liability. By proactively managing tax obligations, taxpayers can maximize their after-tax income and avoid costly penalties or interest charges.

Tax Planning Strategies

Effective tax planning involves implementing strategies that reduce taxable income, increase deductions, and take advantage of available tax credits. Some common strategies include:

- Maximizing contributions to retirement accounts, such as 401(k)s and IRAs

- Utilizing tax-advantaged investment vehicles, such as municipal bonds

- Claiming eligible itemized deductions, such as mortgage interest and charitable contributions

- Harvesting capital losses to offset capital gains

- Gifting assets to charitable organizations or family members

Preparing for Tax Season

To minimize tax-related stress and ensure a smooth tax filing process, individuals should take the following steps:

- Gather all necessary tax documents, such as W-2s, 1099s, and receipts

- Review tax laws and regulations to understand applicable deductions and credits

- Consider using tax preparation software or consulting a tax professional for assistance

- File taxes on time to avoid penalties and interest charges

- Keep organized records for future reference

Answers to Common Questions: Employment And Taxes Everfi Answers

What are the different types of income taxes?

Income taxes are categorized into federal income tax, state income tax, and local income tax.

How are employment taxes calculated?

Employment taxes are calculated based on a percentage of an individual’s wages, with the employer and employee each responsible for withholding a portion.

What is the difference between tax credits and tax deductions?

Tax credits directly reduce the amount of tax owed, while tax deductions reduce the amount of income subject to taxation.